Sitharam announces tax bonanza for corporates, exchequer to take Rs 1.45L cr hit

NEW DELHI | September 20, 2019 (IANS):

In a major bonanza for corporates as part of measures to promote growth and investment, Finance Minister Nirmala Sitharaman on Friday announced to slash corporate tax rate to 22 per cent for domestic companies and 15 per cent for new domestic manufacturing companies, besides other fiscal reliefs.

The effective tax rate for these companies would now be 25.17 per cent, inclusive of surcharge and cess. Also, such companies shall not be required to pay Minimum Alternate Tax (MAT).

The total revenue foregone for the reduction in corporate tax rate and other relief is estimated at Rs 1,45,000 crore. This is the biggest announcement so far by the Modi 2.0 government to fight the slowdown, which dragged down the GDP growth to a six-year low of 5 per cent in the April-June quarter of the current fiscal.

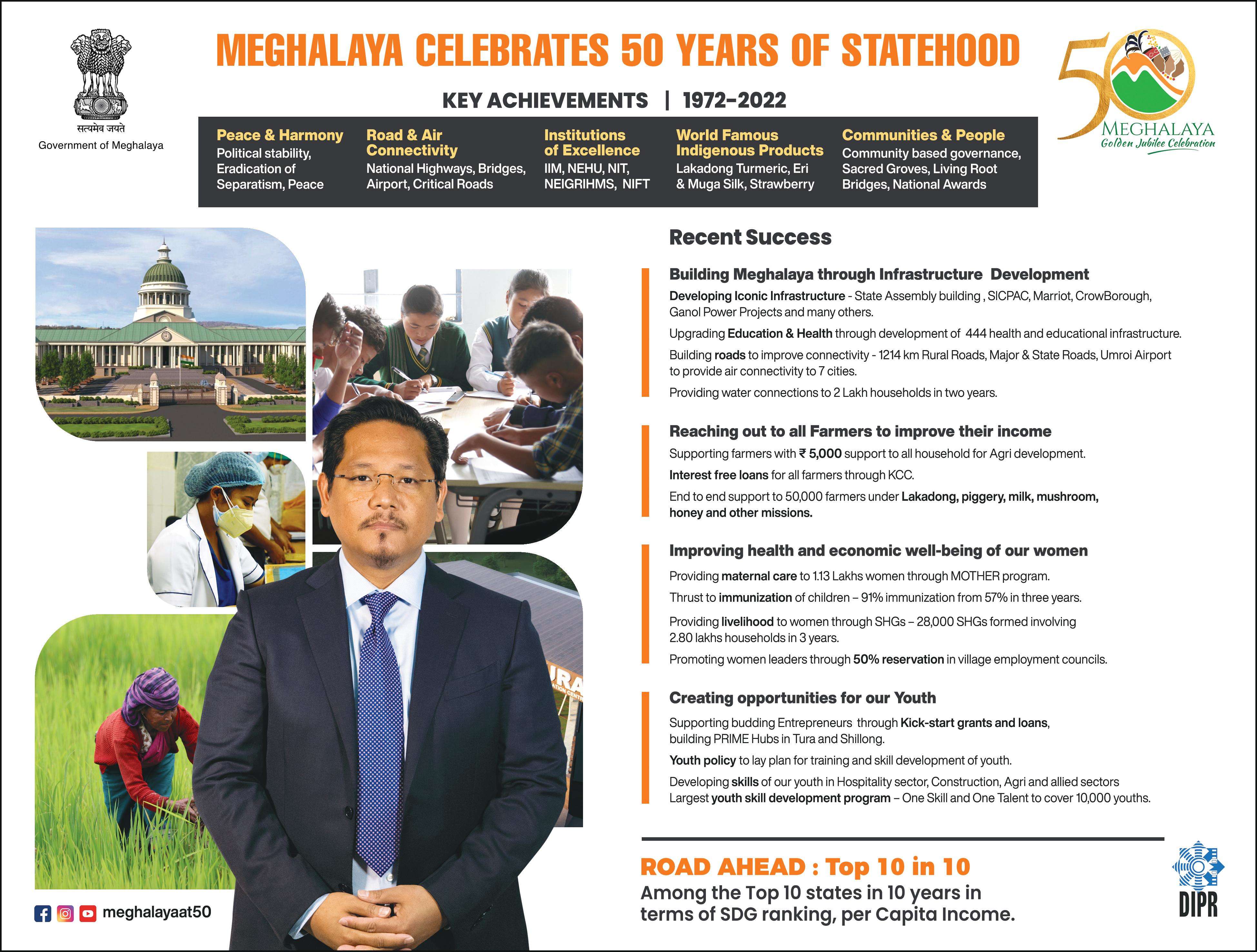

ALSO READ: Meghalaya: Committee meeting held to discuss amendment of Sixth Schedule

The government has brought in the Taxation Laws (Amendment) Ordinance 2019 to effect lower tax for corporates.

A company, which does not opt for the concessional tax regime and avails the tax exemptions, would continue to pay tax at the pre-amended rate. However, these companies can opt for the concessional tax regime after expiry of their tax holiday/exemption period.

ALSO READ: Meghalaya: 3.2 magnitude earthquake jolts EGH

"After the exercise of the option they shall be liable to pay tax at the rate of 22 per cent and option once exercised cannot be subsequently withdrawn. Further, in order to provide relief to companies which continue to avail exemptions/incentives, the rate of Minimum Alternate Tax has been reduced from existing 18.5 per cent to 15 per cent," a Finance Ministry statement said.

In order to stabilise the flow of funds into the capital market, the government has said that the enhanced surcharge introduced by the Finance (No.2) Act, 2019 will not apply on capital gains arising on sale of equity share in a company or a unit of an equity oriented fund or a unit of a business trust liable for securities transaction tax.

ALSO READ: Man booked for rape, blackmail & having unnatural intercourse with wife

"The enhanced surcharge shall also not apply to capital gains arising on sale of any security, including derivatives, in the hands of Foreign Portfolio Investors (FPIs). In order to provide relief to listed companies, which have already made a public announcement of buy-back before July 5, 2019, it is provided that tax on a buy-back of shares in case of such companies shall not be charged," the statement said.

The sharp tax rate cut has been announced even as revenue collection on account of both direct and indirect taxes are far below expectations.